Deloitte analysis: Intense activity on the Romanian M&A market in 2018

11 Ianuarie 2019 BizLawyer

In 2018, 14 deals with a disclosed or estimated value of at least 100 million euros were announced.

|

|

Ioana Filipescu, Corporate Finance Partner, Deloitte Romania |

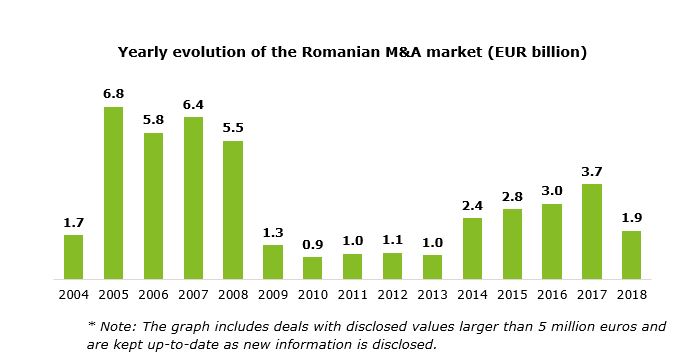

The Romanian M&A market neared 2 billion euros in 2018, according to Deloitte Romania research, based on public sources and disclosed deal values. If estimates for deals whose value was not disclosed were factored in, Deloitte estimates that the Romanian M&A market was somewhere between 3.8 and 4.3 billion euros, slightly below the previous year.

“We witnessed a slight diminution of M&A activity in 2018, after a very specific set of circumstances in 2017, namely a record number of deals between 100 and 500 million euros. Despite this slight YOY drop, the market remains at a robust level, as expected in a year of economic growth. The events of 2018 that represented a premiere were the two financing rounds obtained by UiPath, which attracted strong investment funds from around the world, thus becoming the first Romanian unicorn,” stated Ioana Filipescu, Corporate Finance Partner, Deloitte Romania.

“We witnessed a slight diminution of M&A activity in 2018, after a very specific set of circumstances in 2017, namely a record number of deals between 100 and 500 million euros. Despite this slight YOY drop, the market remains at a robust level, as expected in a year of economic growth. The events of 2018 that represented a premiere were the two financing rounds obtained by UiPath, which attracted strong investment funds from around the world, thus becoming the first Romanian unicorn,” stated Ioana Filipescu, Corporate Finance Partner, Deloitte Romania.

In 2018, 14 deals with a disclosed or estimated value of at least 100 million euros were announced. In total, there were 96 deals observed by Deloitte in 2018. The average value of the disclosed ones was 50 million euros.

The largest deals of 2018 were:

- Vodafone's acquisition of Liberty Global shares in Germany, the Czech Republic, Hungary and Romania (undisclosed value for Romania);

- the acquisition of Zentiva Group, including Zentiva SA Romania, former Sicomed, by Advent International (deal value estimated at 287 million euros, by applying the disclosed EBITDA multiple to the 2017 results of Zentiva SA);

- the sale of Agricost to Al Dahra group, the largest deal in Romanian agriculture (value of 200 million euros);

- the acquisition of The Bridge office building by the Paval brothers from Forte Partners (deal value undisclosed);

- the acquisition of a 7.5% stake in UiPath by a consortium of investors led by Sequoia Capital; following this acquisition, the company’s valuation reached 2.6 billion euros (deal value of 194 million euros); it marks the second round of financing for UiPath in 2018, six months from the first one;

- the takeover of the Oregon Park office project in Barbu Vacarescu, Pipera area, by Lion's Head Investment, which marks its first acquisition in Romania (undisclosed value);

- the acquisition by the German group Phoenix of Farmexim distributor and Help Net network (undisclosed value);

- the sale by SIF Oltenia of the 6.3% stake in BCR to Erste Group Bank (value: 140 million euros);

- Series B funding granted by Accel, Capital G and Kleiner Perkins Caufield & Byers to the Romanian start-up UiPath specializing in the development of solutions for automating internal processes using robotics (124 million euros). Following this transaction, UiPath has become the first Romanian unicorn, a start-up whose valuation exceeded one billion dollars;

- the sale of Urgent Cargus by Abris investment fund to Mid Europa, the largest deal in this sector so far (deal value undisclosed);

- the acquisition of ArcelorMittal Galati by Liberty house, together with the entities in Macedonia, Italy and the Czech Republic (undisclosed value);

- the acquisition of a 23% stake in Alro, the aluminum producer from Slatina, by Paval Holding, an investment vehicle controlled by the Paval brothers (disclosed value of 108 million euros);

- the acquisition of Betty Ice, the ice cream manufacturer, by Unilver, at the end of a competitive sales process (undisclosed value);

- the acquisition of Sun Plaza, the Novotel Hotel and Sun Offfices by Immofinanz (deal value undisclosed).

The activity of private equity funds remained high in 2018, with 12 announced deals. Topping the charts was the acquisition of Zentiva (including the local player, Zentiva SA) by Advent International. The total value of private equity deals was of over 1.1 billion euros, according to Deloitte estimates.

“The interest of private equity for Romania has remained, given that Romanian businesses have continued to grow and the macroeconomic fundamentals have largely remained unchanged from the previous year,” added Ioana Filipescu.

In 2018, the Deloitte Romania Corporate Finance team assisted the owners of Farmexim/Help Net in the sale to Phoenix, assisted Oresa Ventures in the sale of Fabryo, the decorative coatings manufacturer, to AkzoNobel, as well as the sole shareholder of Animax in the sale to TRG and the shareholders of IKB in the sale to BNP Paribas.

Together with Deloitte UK and Reff & Associates, the Corporate Finance team assisted Chimcomplex SA Borzesti in their bid to secure funding for the financing required to acquire the assets of Oltchim SA, in insolvency. As a result of this deal, Chimcomplex will become the largest chemicals manufacturer in Romania.

The Romanian M&A market, in 2018:

• market value (disclosed deals value): 1.9 billion euros;

• average value (disclosed deals value): 50 million euros;

• market value (including Deloitte estimates of undisclosed deals): between 3.8 and 4.3 billion euros;

• number of deals (including deals with undisclosed value): 96;

• number of deals with a disclosed or estimated value of at least 100 million euros: 14.

• market value (disclosed deals value): 1.9 billion euros;

• average value (disclosed deals value): 50 million euros;

• market value (including Deloitte estimates of undisclosed deals): between 3.8 and 4.3 billion euros;

• number of deals (including deals with undisclosed value): 96;

• number of deals with a disclosed or estimated value of at least 100 million euros: 14.

| Publicitate pe BizLawyer? |

|

| Articol 4652 / 4654 | Următorul articol |

| Publicitate pe BizLawyer? |

|

BREAKING NEWS

ESENTIAL

Bondoc & Asociații, consultanții vânzătorilor în tranzacția prin care Grupul LuxVet preia rețeaua Mobile Vet

LegiTeam: CMS CAMERON MCKENNA NABARRO OLSWANG LLP SCP is looking for: Associate | Commercial group (3-4 years definitive ̸ qualified lawyer)

Pas strategic pentru Legal Ground | Firma independentă de tip boutique se alătură rețelei globale The Law Firm Network, cunoascută pentru selectictivitate și criteriile de aderare stricte. Răspuns firesc la nevoile tot mai sofisticate ale clienților corporativi, care caută soluții juridice integrate în tranzacții ce depășesc adesea frontierele naționale

LegiTeam | RTPR is looking for a litigation lawyer (3-4 years of experience)

Bohâlțeanu & Asociații și Țuca Zbârcea & Asociații au asistat Premier Energy și Omnia Capital într-o suită complexă de tranzacții încrucișate, vizând consolidarea portofoliilor de energie regenerabilă și reorganizarea strategică a activelor

Echipele reunite Peligrad Law și David & Baias obțin o hotărâre de referința a Tribunalului Uniunii Europene privind încadrarea tarifara a băuturii tip cidru, marca Strongbow, care confirma ca nivelul accizei pentru această băutură este zero

Remontada și victorie definitivă în fața Curții de Apel Ploiești pentru echipa de litigii fiscale a RTPR pentru Rosti Romania SRL | Ajustarea pierderii fiscale efectuată prin estimare considerată nelegală; dosarul prețurilor de transfer necontestat de organele fiscale trebuie avut în vedere

România a pierdut arbitrajul ICSID cerut de mai mulți dezvoltatori de parcuri fotovoltaice. Comitetul ad-hoc format din trei arbitri a respins cererea de anulare a hotărârii Tribunalului prin care statul român a fost obligat să plătească peste 40 mil. € | Reclamanții au mers cu King & Spalding (Houston și Paris), apărarea a fost asigurată de o firmă americană și una locală

Exim Banca Românească, parte a consorțiului internațional de bănci care finanțează Ogrezeni, unul dintre cele mai mari proiecte hibride din Europa, cu 460 mil. € | Schoenherr și Clifford Chance Badea, în tranzacție

BERD, CEECAT Capital și Morphosis Capital își marchează exitul din investiția în La Cocoș. Osborne Clarke, Van Campen Liem și Noerr, în tranzacție, alături de trei firme locale de avocați

Filip & Company a asistat Veranda Obor S.A. în obținerea unei finanțări de 36 milioane euro de la CEC Bank. Echipa, coordonată de Alexandra Manciulea (partner) și Rebecca Marina (counsel)

O promovare din interior care confirmă meritocrația și creșterea organică într-una dintre cele mai puternice firme de avocatură din România | De vorbă cu Ramona Pentilescu, avocatul care a crescut în PNSA de la primii pași în profesie până la poziția de partener, despre vocație, rigoare și reperele care i-au susținut evoluția profesională într-un cadru în care contează respectul pentru profesie și coerența valorilor

Citeste pe SeeNews Digital Network

-

BizBanker

-

BizLeader

- in curand...

-

SeeNews

in curand...

RSS

RSS